Rumored Buzz on Amur Capital Management Corporation

Table of ContentsWhat Does Amur Capital Management Corporation Mean?3 Easy Facts About Amur Capital Management Corporation DescribedRumored Buzz on Amur Capital Management CorporationAmur Capital Management Corporation Things To Know Before You Get ThisAmur Capital Management Corporation for BeginnersThe Only Guide for Amur Capital Management CorporationSome Known Facts About Amur Capital Management Corporation.

A reduced P/E ratio might suggest that a business is undervalued, or that financiers anticipate the company to face extra tough times in advance. Investors can utilize the average P/E ratio of various other companies in the same sector to develop a standard.

4 Simple Techniques For Amur Capital Management Corporation

A supply's P/E proportion is very easy to discover on the majority of economic reporting sites. This number shows the volatility of a supply in comparison to the market as a whole.

A supply with a beta of over 1 is in theory more unstable than the marketplace. As an example, a safety with a beta of 1.3 is 30% even more volatile than the market. If the S&P 500 surges 5%, a stock with a beta of 1. https://dzone.com/users/5144927/amurcapitalmc.html.3 can be expected to rise by 8%

The smart Trick of Amur Capital Management Corporation That Nobody is Discussing

EPS is a dollar figure standing for the section of a business's profits, after tax obligations and preferred supply returns, that is assigned to every share of common supply. Investors can utilize this number to assess exactly how well a firm can deliver worth to shareholders. A higher EPS results in greater share rates.

If a firm regularly fails to deliver on incomes forecasts, a capitalist may desire to reevaluate purchasing the stock - accredited investor. The estimation is basic. If a firm has a web earnings of $40 million and pays $4 million in returns, then the remaining sum of $36 million is split by the number of shares exceptional

Indicators on Amur Capital Management Corporation You Should Know

Investors usually get interested in a supply after reading headlines about its phenomenal efficiency. A look at the fad in costs over the previous 52 weeks at the least is essential to get a sense of where a stock's rate may go next.

Technical experts comb with enormous volumes like this of data in an initiative to anticipate the direction of stock costs. Basic evaluation fits the demands of a lot of capitalists and has the benefit of making good feeling in the genuine globe.

They believe prices follow a pattern, and if they can decode the pattern they can profit from it with well-timed trades. In recent years, technology has actually allowed more investors to exercise this design of spending since the tools and the information are extra available than ever before. Fundamental analysts think about the inherent worth of a supply.

Amur Capital Management Corporation for Dummies

Technical evaluation is finest matched to a person that has the time and convenience degree with data to put unlimited numbers to make use of. Over a period of 20 years, yearly fees of 0.50% on a $100,000 investment will certainly minimize the profile's value by $10,000. Over the very same period, a 1% charge will reduce the exact same profile by $30,000.

The trend is with you (https://www.magcloud.com/user/amurcapitalmc). Take benefit of the trend and shop around for the least expensive expense.

The Greatest Guide To Amur Capital Management Corporation

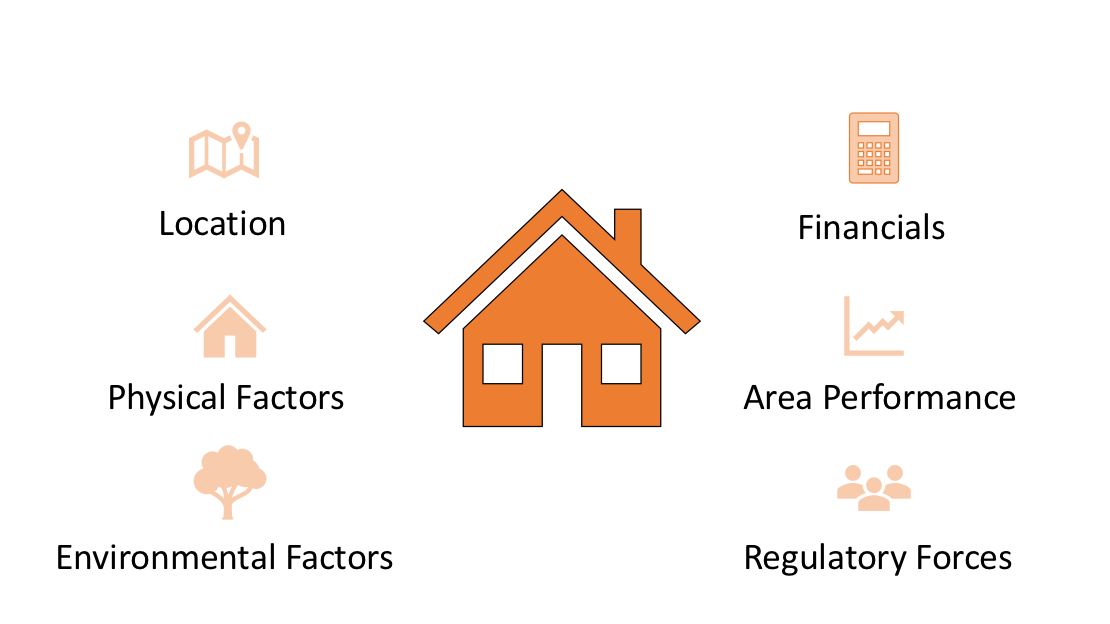

, eco-friendly area, scenic sights, and the neighborhood's standing variable plainly into residential property valuations. A crucial when thinking about residential property location is the mid-to-long-term sight concerning exactly how the location is anticipated to develop over the financial investment period.

Fascination About Amur Capital Management Corporation

Thoroughly evaluate the possession and desired use of the instant locations where you intend to invest. One method to collect details regarding the prospects of the vicinity of the residential or commercial property you are taking into consideration is to speak to the community hall or other public agencies in charge of zoning and urban preparation.

Property assessment is important for funding during the acquisition, sale price, financial investment analysis, insurance, and taxationthey all rely on property assessment. Commonly utilized genuine estate assessment techniques include: Sales contrast method: recent similar sales of homes with similar characteristicsmost common and suitable for both new and old residential properties Expense technique: the expense of the land and building and construction, minus depreciation appropriate for new building Income method: based upon anticipated cash inflowssuitable for rentals Offered the low liquidity and high-value financial investment in realty, a lack of clarity on purpose may result in unanticipated results, including monetary distressparticularly if the financial investment is mortgaged. This offers normal revenue and long-lasting value recognition. This is normally for quick, small to medium profitthe regular residential or commercial property is under building and offered at a profit on conclusion.